CRUX Asia Ex-Japan Fund - Twelve-Month Review: Attribution, Strategy, and Outlook

Investors in Asian equities have faced a challenging 12 months, given the geopolitical, economic, and regulatory risks within the region, particularly in China. These factors have led to increased volatility and a significant decline in market multiples due to risk aversion. For the CRUX Asia Ex-Japan Fund, this has been a tough period as value has outperformed growth in most major markets, price discovery has declined, and stock prices have not followed earnings momentum.

Given the fund’s growth and optimism bias, underperformance in this environment was anticipated. However, we are disappointed that we have not done better, especially in the past six months. The fund NAV fell by 9%, compared to the benchmark’s 5% decline, leading to a 4% underperformance over 12 months. China’s attribution contributed a negative 4.5%, with over 3% of this coming from our overweight position in the country. Excluding China, total attribution was positive. We attribute all this underperformance to the period from March to May of this year, 2023, during which China significantly diverged from other regional stock markets.

Strategy

Given the unprecedented breakdown of correlations within the Asia Ex-Japan asset class this year, we believe it is best to view the fund as divided into China and Ex-China segments. Whereas in Ex-China we have had several significant success stories in the technology and consumer space, it is notable that Chinese technology stocks have not participated in the current global technology rally.

Our China strategy has remained consistent over the last few years. Back in 2021, we believed that sentiment towards China, particularly technology stocks, was extremely high and that political and regulatory risks were not being discounted. We took one of our largest ever underweight positions in the market early in 2021, which yielded positive results for that year. Upon the fund’s launch in October 2021, we began to reduce this significant underweight as expectations normalized. Our plan was to eventually go overweight once stocks had discounted the economic slowdown and regulatory risk.

The Ukraine War and the geopolitical fallout, combined with anti-Chinese sentiment in the US, further weakened Chinese assets into distressed territory. As a result, we made investments into China in March, June, and November 2022.

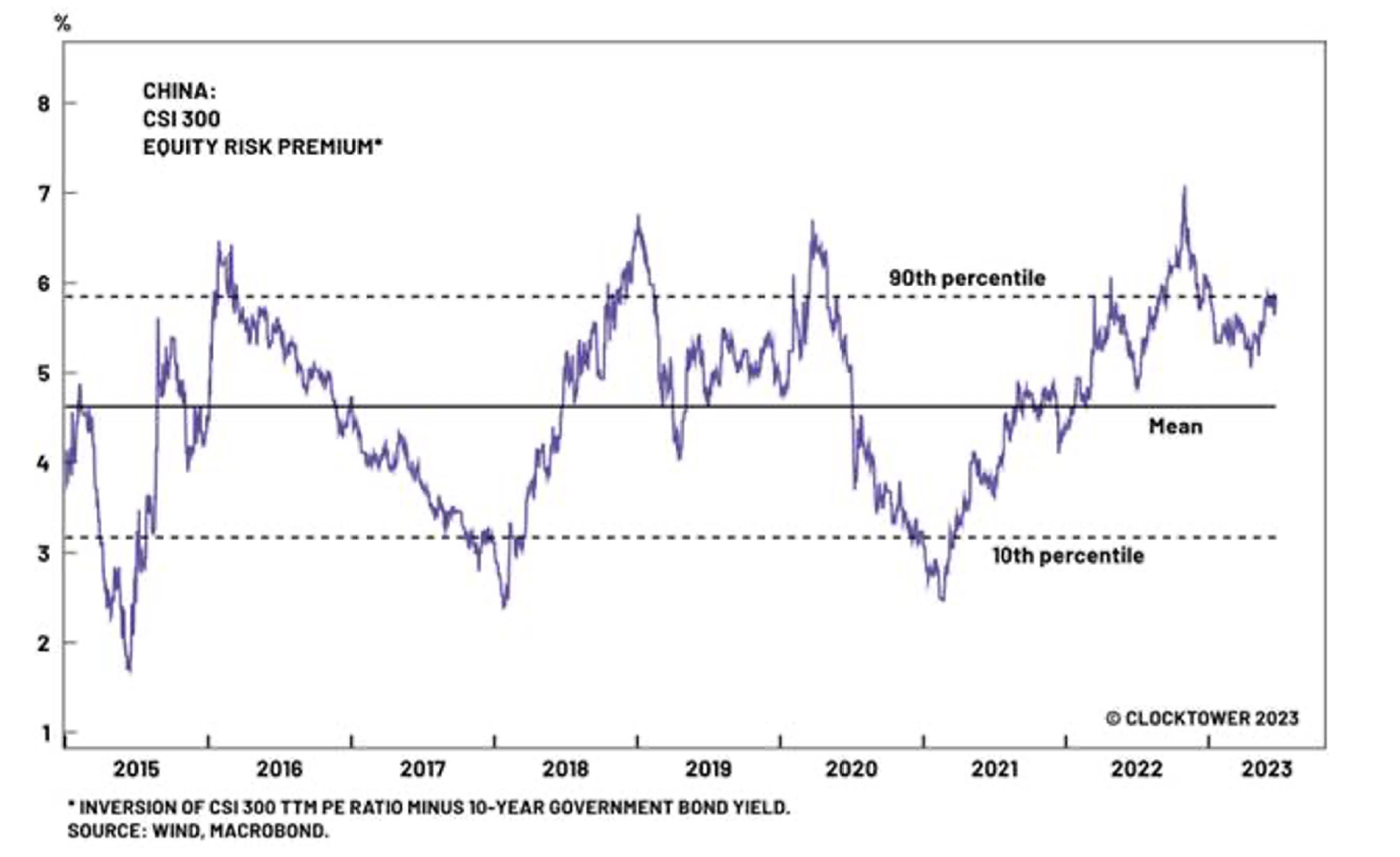

The strategy saw a significant shift when China moved from a zero-Covid approach to fully opening up. This, along with tentative changes to its pro-Russian stance,a strict regulatory clampdown on technology, and a bias towards economic stimulus, served as the catalyst to significantly increase our weighting in the Chinese markets via technology and consumer-related names. This change led to quick and substantial gains, with the fund outperforming early in the current year. However, increased geopolitical concerns following the ‘spy balloon’ incident and the lack of economic followthrough in Chinese economic growth led to another sizable retracement of the Chinese market. The chart below illustrates the Chinese equity risk premium, demonstrating that buying, as we have done over the last 18 months when the risk premium is above the 90th percentile, has historically led to substantial gains.

Regarding other parts of Asia Ex-Japan, India was the best performer in our portfolio, contributing positively to the fund. We expect that the Indian economy will continue its growth trajectory, underpinned by a young demographic, increased digitalisation, and structural reforms. We remain optimistic about the country’s prospects and have increased our investment in the country. Our holdings in both South Korea and Taiwan have also performed well.

Lastly, while there are always risks, the fund is well-positioned to take advantage of the potential for recovery in China. We will be vigilant and flexible, as we have always been, and are prepared to reduce exposure if events warrant. Despite the pain, we firmly believe that maintaining our growth-oriented investment approach will result in a favourable outcome.

Outlook: Is This Time Different?

The challenges are well-understood: the Chinese economy carries a heavy debt load, the property market has peaked, and so have related construction projects. This has a significant disinflationary effect on GDP. Without a positive combination of fiscal, exports, and private sector-led growth, the country faces a long period of stagnation. The current Chinese Communist Party (CCP) administration’s reluctance to stimulate the economy and continued anti-construction sentiment is playing into this structural weakness. Remarks such as “we must prepare for hard times” do not inspire confidence. Moreover, the continued regulatory clampdown on the private sector and technology in particular - the biggest source of jobs and productivity growth - implies a sub-par growth trajectory. Meanwhile, geopolitical spats with the US, particularly over Taiwan and the banning of leading-edge chips, could lead China to become a larger autarkic version of North Korea. Investors are extrapolating from what we have seen in Russia: sanctions, complete trade bans, the end of foreign capital flows, and equities effectively going to zero. The risk of war and, as we see in Russia, a significant increase in domestic instability is feared.

What is the probability of these risks? What is priced in by the markets, and is the upside reward worth these known issues?

The upside is the easiest to answer. In the prior decade, 2011-2021, technological innovation was largely centred in two locations: the West coast of the US and the East coast of China. Stock prices and market performance followed these centres of innovation, leading to spectacular returns in leading Chinese technology companies. Today, with the emerging trends of total electrification (renewables and Electric Vehicles (EVs)), digitisation (Artificial Intelligence (AI) and cloud computing), and space exploration, China is a global leader and fast follower in these fields. This is due to huge domestic talent, a large local market, innovative companies, historically faster adoption rates, and a growing economy. For instance, in the field of AI, China’s expenditure last year was an estimated $4 billion compared to the US’s c.$20 billion. This year, that number is anticipated to rise to at least $15 billion.

Today, these technology names are significantly cheaper with very low expectations, compared with US and global peers. We believe the allure of AI-led innovation will entice mass adoption across China.

Our key call is that this time isn’t different; China is still central to the global economic system. The risk of mutual economic disaster will mitigate US containment effects, the risk of war in the Taiwan Straits is dramatically exaggerated, pragmatism prevails, and the Chinese leadership continues its 50-year trend of opening up and technological innovation. At the bottom of the market, fear always overtakes greed, and negative issues are taken towards their extreme. We have spent a lot of time debating all the possible disaster scenarios; this information alone leads one to assume that most, if not all, of these issues are already discounted by the market.

Changes in China we would like to see: Perspectives on China and Russia, positive shifts in domestic fiscal policy, unshackling of the private sector, and enhancements in international relationships.

1. China versus Russia: It’s crucial to note that China greatly differs from Russia in several ways. It exhibits a high level of decentralisation, boasts multiple power sources, and operates strong institutions. Its technological advancement and sizable private sector are noteworthy. Over the last three decades, Chinese citizens have enjoyed a significant uplift in their living standards, affirming growth as a central pact between the people and the government. However, the fear of revolution and political breakdown, presently intensifying in Russia, is a shared concern for both nations. China’s leadership is set on circumventing a similar fate. The likelihood of any military aggression from China remains minimal barring a major external impetus.

2. Domestic Policy: The domestic economy possesses multiple levers for control. While inflation remains low, the threat of disinflation tipping into deflation is considerably high. Implementing stimulus measures through fiscal and consumer support can make a significant difference and is an achievable goal.

3. Empowering the Private Sector: The Chinese private sector holds the potential to generate employment, stimulate productivity, and foster innovation to propel the nation’s economy. The key ingredient required is confidence.

4. International Relations: The most challenging aspect is deciphering the Sino-American relationship, understanding its trajectory, and how turbulent it may get before reaching a phase of mutual cooperation and agreement. Both nations share a common interest in globalisation, economic prosperity, global stability, and environmental conservation.

As of now, our investments are primarily focused on technological leaders and burgeoning companies within China, where we believe the risk-reward ratio strongly favours long-term returns despite inherent uncertainties. However, it’s essential to acknowledge the emerging bull markets in North Asia, particularly Korea and Taiwan, as well as in India, where our positioning is favourable. These markets present a natural competition for capital within the region.

At the beginning of the year, we anticipated the commencement of a new bull market cycle, primarily driven by technological advancements. The potential impact and scope of Artificial Intelligence (AI), specifically Language Model (LLM), are remarkably broad, disruptive, and exciting. We believe we are well-positioned across all our markets and anticipate continued strong performances, especially from China, throughout the year (over the next 12 months?).

12-Month Attribution Report

Key Points:

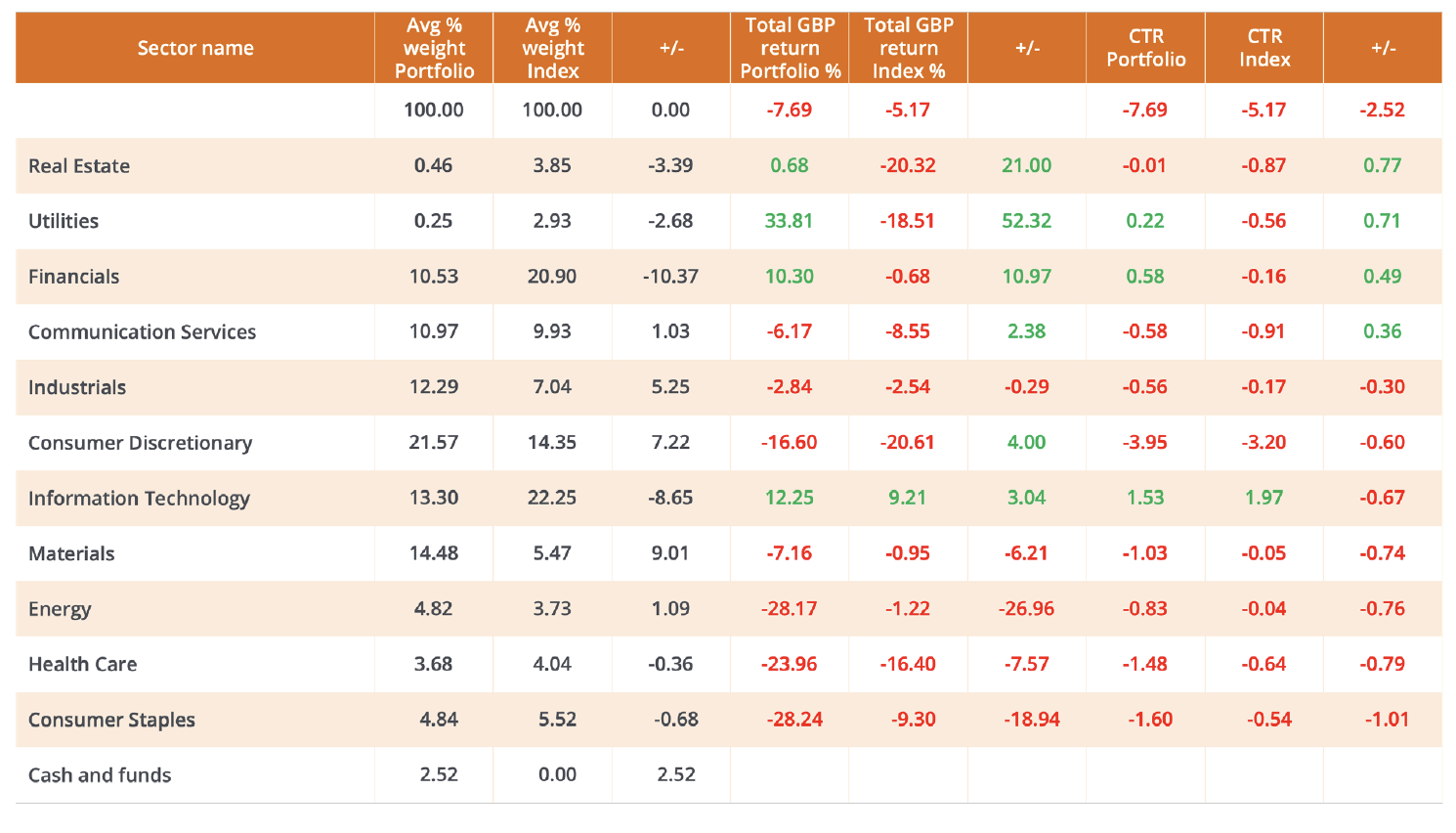

The portfolio’s performance over the past year can be attributed to the combined effect of a large number of stocks experiencing significant falls and an almost equal number witnessing significant rises. Unfortunately, our weighting was tilted more towards the group that declined, resulting in overall underperformance. This was largely due to our asset allocation towards China. Seventeen of our stocks rose more than 30%, but 25 fell more than 30% during the same period. Only four of our top ten holdings provided positive returns, and these accounted for 250 basis points (bps) of underperformance. China and Indonesia were the primary contributors to the portfolio’s underperformance, while India significantly boosted returns. In terms of sectors, Real Estate, Utilities, and Communication Services were positive contributors, while Consumer Staples, Materials, and Energy negatively impacted the portfolio’s performance.

China:

China’s market fell 16% over the period, and our portfolio experienced a slightly higher decline of 17.5%. Our 12% overweight position in China led to a negative attribution of -450bps. Most sectors within China were a drag on performance, with the exception of our Energy holdings. Industrials, Technology, and Healthcare were the worst performers. We had sizable drawdowns in several names due to a lack of price discovery in the Chinese market, which resulted in extreme volatility and significant price movements. Despite these losses, we do not foresee any permanent loss of capital due to company-specific issues:

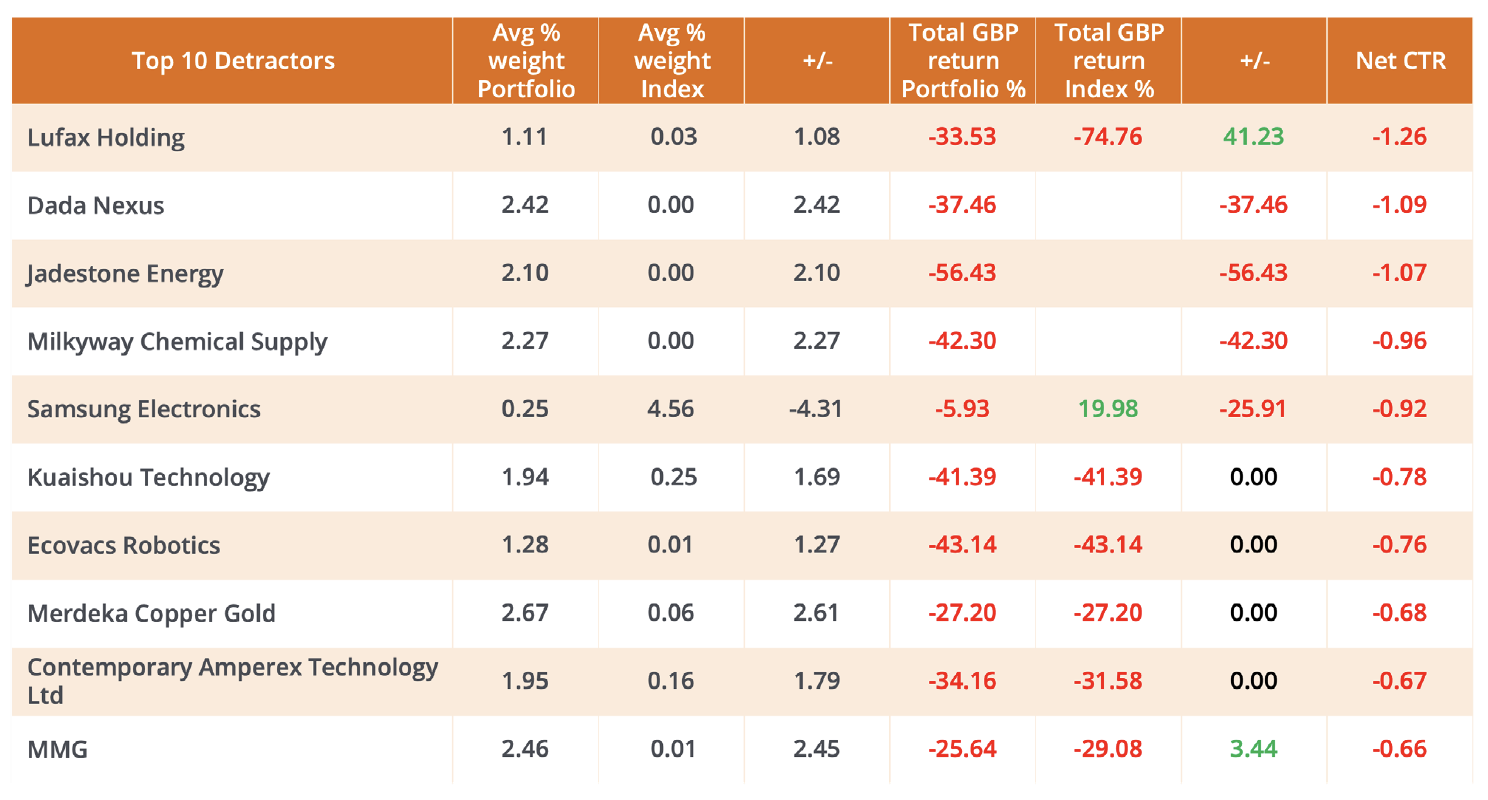

- Lufax declined by 33% during the period. Despite its high beta, we maintain our position due to its quality business model and strong balance sheet.

- Dada Nexus, our last-mile on-demand delivery company, fell by 37% despite moving to profitability quicker than expected. We have continued to add to our position during this period.

- Milkyway declined by 42% due to an unanticipated economic slowdown and margin contraction. We reduced our position significantly prior to this drawdown, saving performance.

- Contemporary Amperex Technology Limited (CATL) saw a 34% decline, yet we have added to our position due to continued earnings growth.

- Hua Medicine fell 45% despite winning approval in China for a groundbreaking regenerative diabetes drug. We retain our position.

- Ecovacs fell 43% due to economic struggles and a sector-wide de-rating. We maintain our position.

- Kuaishou fell 41%, despite consistently surpassing quarterly estimates for the past eight quarters. We believe the market underestimates the quality of the business, management, and growth potential.

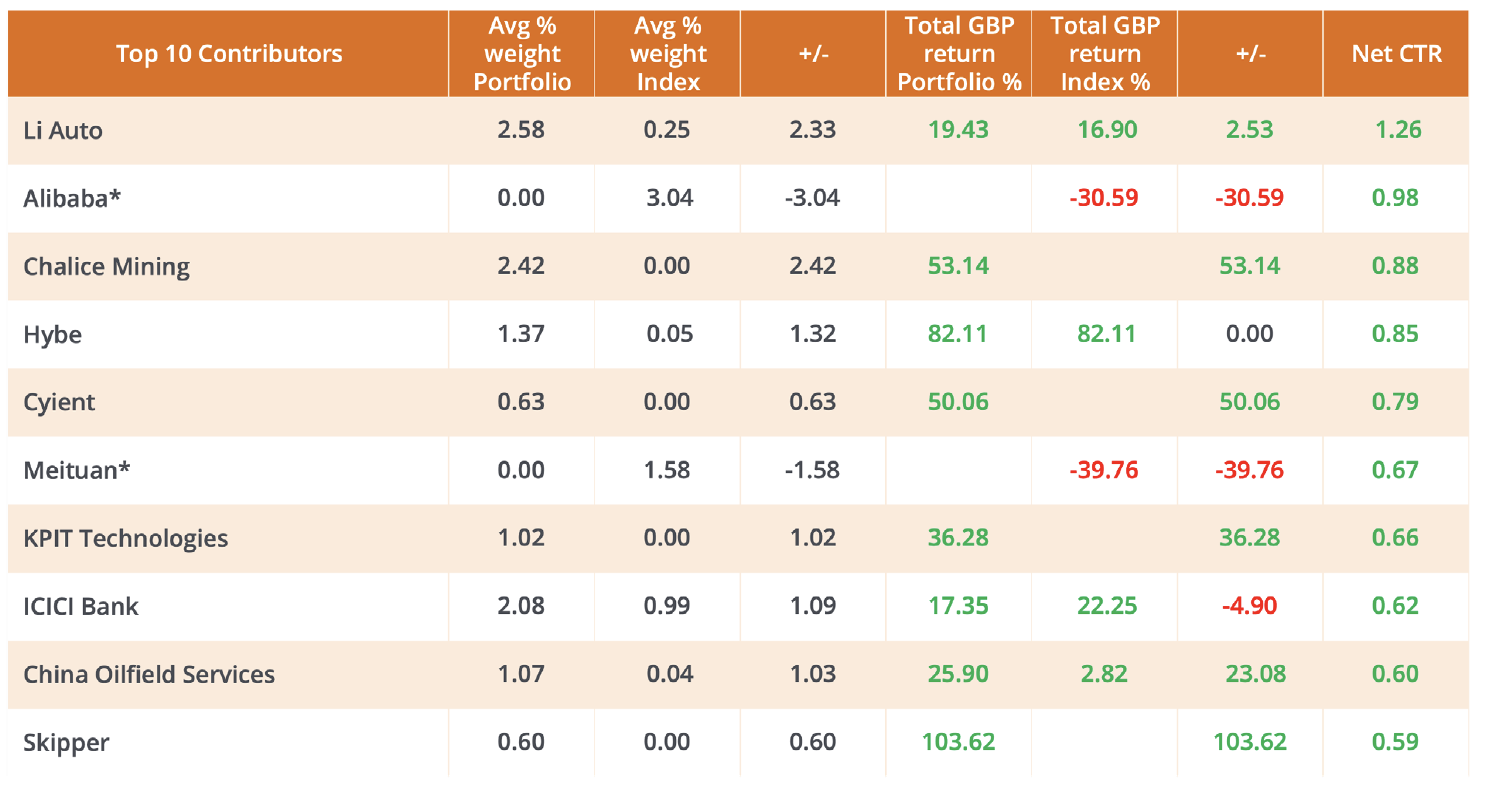

- Li Auto was a bright spot, rose 19% and contributed 130bps of outperformance.

India:

India was a standout performer, where our holdings rose 32% compared to the market’s 12%, adding 300bps of performance. Key contributors included Cyient, KPIT, Skipper, Indusind Bank, Kaynes, and Hindustan Aeronautics. The only negative contributor within India was Happiest Minds, which declined by 13%.

South Korea:

We outperformed a rising market by 11%, with the South Korean portfolio rising 22%, resulting in a small positive attribution given our underweight. A notable contributor was Hybe, which rose 82% on renewed enthusiasm for KPOP and an improved earnings outlook. Our underweight position in Samsung Electronics was the primary drag on performance.

Taiwan:

We outperformed the market by 1%, with our technology AI-related names rising significantly, but our underweight position negatively affected performance. Our underweight position in Taiwan Semiconductor Manufacturing Company (TSMC) was the most significant detractor.

Australia and Indonesia:

Chalice Mining in Australia rose 53% on the back of new discoveries in its ore body. However, Merdeka Copper in Indonesia fell 27% due to downgrades after an extension to its mine plan led to a reduction in the discounted cash flow (DCF) value. Jadestone, our Exploration and Production (E&P) Company, experienced a significant 56% drop and was a material detractor after it had to issue an emergency rights offering. This event resulted in a permanent impairment to its value and represented the major stock-specific loss we suffered during the period.

Crux Asia Ex Japan - Sector attribution (12 months)

Crux Asia Ex Japan - Country attribution (12 months)

Sources: Bloomberg, Crux Asset Management from 30 June 2022 to 30 June 2023. Kindly note attribution data will differ from a fund NAV performance due to timing and the effect of expenses. Attribution data is gross of expenses and based on a market closing prices. Fund NAV performance is based on midday GMT prices. Past performance is not a reliable indicator of future results. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Crux Asia Ex Japan - Top 10 portfolio contributors (12 months)

Crux Asia Ex Japan - Top 10 portfolio detractors (12 months)

Sources: Bloomberg, Crux Asset Management from 30 June 2022 to 30 June 2023. Kindly note attribution data will differ from a fund NAV performance due to timing and the effect of expenses. Attribution data is gross of expenses and based on a market closing prices. Fund NAV performance is based on midday GMT prices. Past performance is not a reliable indicator of future results. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.